Click here to view a PDF of the March 2025 IEPC Newsletter.

In this issue:

Click here to view a PDF of the March 2025 IEPC Newsletter.

In this issue:

Free to All Friends of IEPC!

Time & Date: 9:00 AM – 9:30 AM PT on the fourth Monday of each month.

Membership in IEPC is not required to attend. Advance registration for the meeting is required. After registering, you will receive a confirmation email containing information on how to join the call! To receive a registration link, email admin@iepc.org.

April 28, 2025: California ACEP Updates, Elena Lopez-Gusman

May 19, 2025: The Corporate Practice of Medicine, Dr. Robert McNamara

June 23, 2025: ACEP Legislative Updates, Laura Wooster

July 28, 2025: Data Updates from EBDA, Dr. Jim Augustine

August 25, 2025: SB 43 and the Expansion of 5150 holds, Mike Phillips

September 22, 2025: Reimbursement and Advocacy Hot Topics in 2025 for Emergency Medicine, Dr. Ed Gaines

October 26, 2025: The EM Labor Market, Dr. Leon Adelman

November 24, 2025: Legal Updates for Emergency Physicians, Andrew Selesnick

The IEPC 2025 Board of Directors took office in January of this year.

Robert Chavez, MD – President

Don Shook, MD – Treasurer

Sameer Mistry, MD – Vice President

Andrew Fenton, MD – Vice President

Mike Gertz, MD – Secretary

Practice Essentials of Emergency Medicine is designed to augment your knowledge of several critical business topics. The modules are free to ACEP and EMRA members. Topics include Reimbursement, Contracts, Negotiations, Operations, Billing and Coding, Risk Management, Quality and Patient Safety, Leadership and Innovation, Legal and Regulatory issues, EM Informatics, and Personal Finance. https://www.acep.org/education/practice-essentials.

Clay Whiting, MD

IEPC Member at Scripps Mercy

in San Diego

Dr. Clay Whiting, IEPC member at Scripps Mercy in San Diego, discussed violence in the emergency department with KPBS. See Link to the story by Heidi de Marco, New California law target ER violence but some say it’s not enough. ACEP found that more than 90% of ER doctors were threatened or attacked in the previous year. Even when incidents are reported, Whiting said accountability is rare. AB 977 went into effect in January. The new law increases jail time for people who assault ER workings from 6 months to one year, and raises penalties up to $2,000.

Roneet Lev, MD, FACEP

Executive Director, IEPC

In the ABCs of resuscitation, “A” is for airway. You would not think emergency physicians need such a lesson, but in a recent chaotic rescue, I noticed that sometimes the basics are forgotten.

Try this. Next time you are laying down on a hard surface, hyperextend your head and try to breathe. Now lift your head to your neutral position and take a breath. You don’t have to be in a code blue to feel the difference in a patient airway.

When I was volunteering in Israel over the past year, we trained the medics, emphasizing the basics. Dr. Debra Weiss, director of the emergency department at Asuta Hospital, devised an interactive training session that emphasized proper head positioning and jaw thrust. All participants felt for themselves how it is harder to breath when the head is misaligned. They also learned a trick of placing the patient’s head on the knees to proper position the head and then apply the jaw thrust.

The Israeli airway lesson was fresh on my mind when I attended a special event with thousands of people. People crowded at the stage for hours. It was hot, the crowd was older, perhaps alcohol was involved, and some people started to drop. In the area where I was standing, four people experienced syncope. It was quite dramatic. Security had me stay near the speakers in a spot where I can watch the crowd. I missed most of the show, and may have damaged my hearing, but I enjoyed being a doctor in a different setting. After 30-plus years as an emergency physician, I still jump to action when there is a medical emergency.

The crowd, who got to know me as the rescue doctor, directed me to the middle of the thick crowd, where an elderly man lay unconscious. His head was hyperextended, and I initially could not feel a breath. If I held his head up, I could feel good breathing. When his head dropped in extension, his breath diminished. An unconscious head can be very heavy. I had a good Samaritan assist in holding up the head.

There was no way to get a gurney into this crowd. The unresponsive man was lifted on the shoulders of several men and carried out of the dance floor to an open area where we met the official medical responders. This team had doctors, residents, and paramedics. I introduced myself as an emergency physician, gave my report, and moved aside to support the man’s son. By the way, speaking to family is important. This man’s son was angry and agitated until I explained what was happening.

I observed the code and watched my patient’s head go back to his hyperextended position. The medical team got an oral airway, a nasal airway, and an ambu bag. It is not easy to intervene in another team’s code, but I gently explained that if they just position his airway, he will breathe.

And hence, I write this article as a reminder that the “A” in airway is important, and to share the trick of laying the victim’s head on your knees to get that perfect neutral and sniffing position. It works, even when you are wearing a sparkly evening gown.

Robert Chavez, MD

President, IEPC

Providence Little Company

of Mary Medical Center Torrance

Hello friends and colleagues,

It is that time of year when your RCM company of CFO should be sending out letters to your OON payers to adjust the qualified payment amount (QPA). The QPA is supposed to be equivalent to the Median-In Network Rate for a given insurance payer. It is subject to be an annual inflationary adjustment starting in 2019. When adjusting for inflation, this should be +24.7% for 2025. This is important because it is one of the criteria utilized in the IDR process and sets your patients cost sharing amounts for a given year. You can also make use of this increase during during your IDR open negotiation as well as your IDR submission.

Also, keep a close eye on your 2025 EOBs to look for a mandatory Medi-Cal rate increase for all Medi-Cal products. The rate increase should be equivalent to 90% of Medicare for E&M codes and 80% of Medicare for all procedures. It will obviously take some time for these rates to go into effect and I suspect we will not see the EOBs reflect the increase until after the first quarter. It would not hurt to send out a letter reminding your Medi-Cal entities of this rate increase, though they should all be aware. Once the increases go into effect, there should be retroactive “catch-up” checks to reimburse back to January 1, 2025 at the new increased rates.

Finally, keep an eye out for any updates affecting the 2.83% Medicare cuts that went into effect January 1, 2025. If Congress passes another continuing resolution, it may have a “Medicare Fix,” which would decrease the cut for the year. If this occurs, have your RCM company reach out to your payers and make sure they adjust their EOBs and check to see if any retroactive payments from Medicare are to be included. (Wishful thinking I know).

Click here to view a PDF of the October 2024 Newsletter.

In this issue:

Free to All Friends of IEPC!

Membership in IEPC is not required to attend. Advance registration for the meeting is required.

After registering, you will receive a confirmation email containing information on how to join

the call! To receive a registration link, email admin@iepc.org.

JOIN US FOR OUR FINAL 2 PRESENTATIONS OF 2024!

| Stephen Freedman and Mark Savoie, of The Doctors Company | Malpractice Updates | October 28, 2024 |

| Dr. Andrew Seleznick | Legal Updates for Emergency Physicians | November 11, 2024 |

Be on the lookout for future updates on the

2025 IEPC Speaker Series!

Roneet Lev, MD, FACEP

Executive Director, IEPC

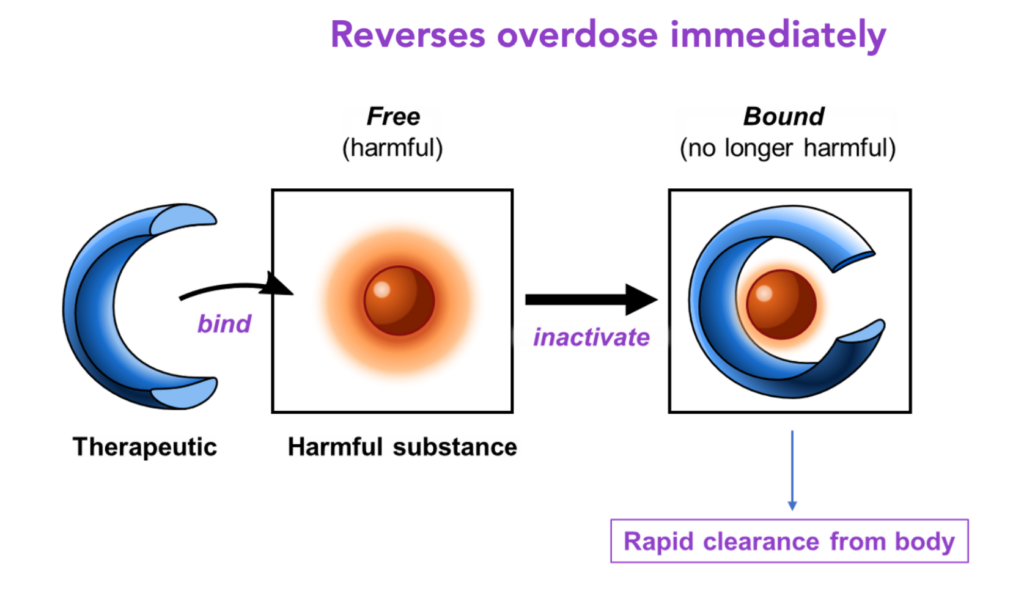

CS-1103 is entering Phase 2 trial. The new drug is a sequestrant that bind methamphetamine within minutes. California is ground zero for meth and we see methamphetamine toxicity daily in the form of agitation, mental health crisis, and cardiac effects. You can read more about CS1103 in an article on Kevin MD.